Unlocking Your Dream Home: A Comprehensive Guide to First Time Homebuyer Programs in NC

Introduction

Are you ready to take the leap into homeownership? If you’re a first time homebuyer in North Carolina, the journey can feel overwhelming—but it doesn’t have to be. In fact, “Unlocking Your Dream Home: A Comprehensive Guide to First Time Homebuyer Programs in NC” is here to help you navigate the process with confidence.

Fortunately, North Carolina offers a variety of programs designed to ease financial strain and simplify the home buying journey. From down payment assistance to affordable mortgage options, knowing your choices is the first step toward turning your dream into reality.

Additionally, if you want to get a better sense of the current housing landscape, check out our Triangle NC Real Estate Update – November 2025. Whether your heart is set on a cozy Durham home or a new construction property in the suburbs, this guide will empower you to confidently navigate first-time home buyer programs in NC.

Understanding First Time Homebuyer Programs in North Carolina

First-time home buyer programs are designed to make homeownership more attainable. Specifically, they typically include low-interest loans, down payment assistance, and grants. As a result, these programs can reduce the upfront costs that often discourage first-time buyers.

In North Carolina, these initiatives are offered by the North Carolina Housing Finance Agency (NCHFA), local housing authorities, and nonprofit organizations. Furthermore, they’re tailored to help buyers with different income levels, credit situations, and housing goals.

Meanwhile, if you’re focusing on Durham, our First-Time Homebuyers Durham post dives deeper into programs specifically for the city. It’s a great resource to see what local grants and incentives may be available to you.

Eligibility Requirements for NC First-Time Home Buyer Programs

While every program has unique requirements, most share the following general criteria:

- First and foremost, you haven’t owned a home in the last three years.

- Additionally, you meet income and purchase price limits.

- Moreover, you complete a homebuyer education course.

- Similarly, you have a minimum credit score (typically 640+).

- Finally, you intend to use the property as your primary residence.

Beyond these basics, some programs also give special consideration to veterans, public service workers, and moderate-income households, thereby making homeownership accessible to a wider range of buyers.

Types of First-Time Homebuyer Assistance Programs in NC

Here are some of the most popular programs for first-time buyers in North Carolina:

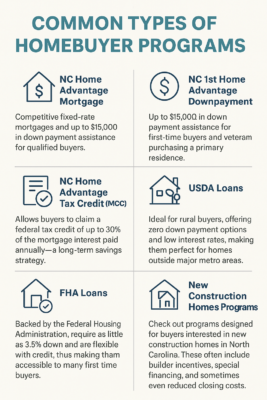

1. NC Home Advantage Mortgage

To begin with, this program offers competitive fixed-rate mortgages and up to $15,000 in down payment assistance for qualified buyers.

2. NC 1st Home Advantage Downpayment

Similarly, this provides up to $15,000 in down payment assistance for first-time buyers and veterans purchasing a primary residence.

3. NC Home Advantage Tax Credit (MCC)

In addition, the Mortgage Credit Certificate allows buyers to claim a federal tax credit of up to 30% of the mortgage interest paid annually—a long-term savings strategy.

4. USDA Loans

On the other hand, USDA loans are ideal for rural buyers, offering zero down payment options and low interest rates, making them perfect for homes outside major metro areas.

5. FHA Loans

Likewise, backed by the Federal Housing Administration, these loans require as little as 3.5% down and are flexible with credit, thus making them accessible to many first-time buyers.

6. New Construction Homes Programs

Finally, if your goal is a brand-new home, check out programs designed for buyers interested in new construction homes in North Carolina. These often include builder incentives, special financing, and sometimes even reduced closing costs.

Key Benefits of NC First-Time Homebuyer Programs

Here’s why first-time buyers should seriously consider these programs:

-

Lower upfront costs through down payment assistance or grants.

-

Competitive interest rates and more manageable monthly payments.

-

Tax benefits that can save thousands over time.

-

Financial guidance and homebuyer education to make smarter decisions.

-

Stronger equity growth in a thriving housing market.

If you’re interested in Durham specifically, see our Homes for Sale in Durham NC – Market Update 2025 to understand why the city continues to be one of the most promising markets for first-time buyers.

How to Apply for NC First-Time Homebuyer Programs

Getting started is easier than you might think:

-

Check your eligibility with NCHFA or a certified local lender.

-

Gather financial documents, including proof of income, employment, and credit history.

-

Work with a REALTOR® who specializes in first-time home buyer programs.

-

Complete a homebuyer education course (many are online and affordable).

-

Submit your application and wait for approval.

💡 Pro Tip: Partnering with a knowledgeable REALTOR®, especially one familiar with Durham programs, will ensure you access every available incentive.

Down Payment Assistance and Financial Aid Options

Beyond standard programs, you may also qualify for:

-

City or county down payment grants (Durham, Raleigh, Charlotte, etc.)

-

Employer-assisted housing programs

-

Nonprofit grants, like Habitat for Humanity

-

Federal programs, including FHA, VA, and USDA loans

Stacking these resources can reduce your out-of-pocket costs and make homeownership more achievable.

Common Myths About First-Time Home Buyer Programs in NC

Many first-time buyers assume:

-

❌ “I need perfect credit.” → Many programs accept scores as low as 640.

-

❌ “I must make a large down payment.” → Some programs offer 0% down options.

-

❌ “I need to be low-income.” → Many moderate-income buyers qualify.

-

❌ “The process is too complicated.” → With professional guidance, it’s straightforward.

Expert Tips for First-Time Homebuyers in North Carolina

-

Get pre-approved early to know your budget.

-

Research neighborhoods and market trends—our Triangle NC Real Estate Update is a great starting point.

-

Ask about closing cost assistance and available grants.

-

Partner with a REALTOR® who specializes in NC and Durham programs.

-

Plan for selling your current home if needed—check our Selling a Home in Durham NC guide for expert tips.

Helpful Resources for NC First-Time Home Buyers

-

Local city and county housing offices

Conclusion: Take the Next Step

Owning your first home in North Carolina is possible, especially when you leverage the right programs and guidance. From down payment assistance to tax credits and new construction incentives, the options are designed to make homeownership accessible and rewarding.

Whether you’re buying your first home in Durham, exploring new construction homes in North Carolina, or planning to sell your current property, Make Your Move Inc. is here to guide you every step of the way.

💬 Ready to find the perfect home? Contact Latrice McFadden, REALTOR®/REALTIST® today, and let’s turn your dream into reality.

📍 Don’t forget to explore our related guides: