If you’re trying to make sense of the North Carolina housing market in 2026, you’re not alone. Between shifting interest rates, evolving inventory levels, and conflicting headlines about what’s “really happening,” it’s easy to feel stuck between fear and urgency.

Here’s the truth: the North Carolina housing market hasn’t disappeared, and opportunity hasn’t passed you by. The market has simply matured. And when you understand what’s actually happening on the ground—particularly in the Triangle region—you can move forward with clarity and confidence.

As someone deeply connected to the real estate landscape across Durham, Raleigh, Chapel Hill, and surrounding areas, I work closely with buyers, sellers, and investors navigating real transactions in real time. My goal isn’t to hype you into action or convince you to wait forever. It’s to give you the data-driven, strategic insight you need to make the smartest move when you’re ready.

Let’s break down exactly what’s happening in the North Carolina housing market right now, what the numbers really mean, and what you should expect for the rest of 2026.

Current State of the North Carolina Housing Market in 2026

Is It a Buyer’s or Seller’s Market?

Right now, the Triangle housing market leans toward balanced to slightly in favor of sellers—but it’s nowhere near the frenzy of 2021-2023. According to the National Association of Realtors, balanced markets create opportunities for both buyers and sellers when approached strategically. Buyers who are educated, prepared, and ready to act are still winning great homes without extreme bidding wars or waived contingencies.

Some pockets, especially updated and move-in-ready properties, still see strong demand and move quickly. Other segments, particularly higher-priced or less updated homes, are taking longer to find committed buyers. This creates opportunities for strategic negotiations that simply didn’t exist during the peak years.

What’s Changed in the North Carolina Housing Market Since 2024-2025?

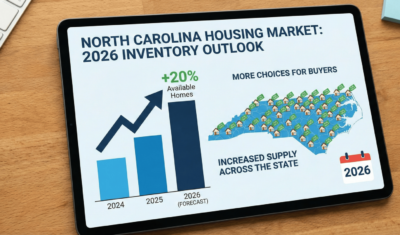

The most significant shift is inventory. We’re seeing more homes come to market compared to the tightest periods of 2024 and early 2025. Inventory has climbed roughly 15-30% year-over-year in many Triangle areas, giving buyers more options and breathing room.

More sellers are testing the market, which means buyers aren’t forced into snap decisions anymore. You can do your homework, compare properties, and find a home that truly fits your needs—without the panic-buying pressure that defined recent years.

Contrary to national narratives predicting slow markets, quality homes in key Triangle corridors are still moving quickly when they’re priced right and marketed strategically. Realtor.com’s market data confirms this trend across growing metros nationwide. The difference now? Buyers are informed and intentional, not frantic. Transactions are happening with less emotion and more strategy, which benefits everyone involved.

North Carolina Housing Market Prices and Home Values in 2026

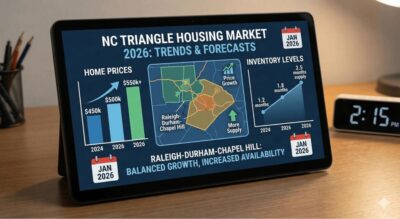

North Carolina Housing Market: Current Median Home Prices Across the Triangle

Pricing across the Triangle has shifted from rapid appreciation to stabilization, with some segments still growing modestly while others level out. Here’s what you need to know about current pricing:

Raleigh: Median prices are generally in the mid-$450,000s, with strong demand for well-located, move-in-ready homes.

Durham: Median prices hover around the low-to-mid $400,000s, depending on neighborhood and property condition.

Chapel Hill: Pricing remains higher, often in the upper-$400,000s to low-$500,000s, supported by limited inventory and consistent demand.

Across the broader Triangle region, the median sits roughly in the mid-$400,000 range.

Year-Over-Year North Carolina Home Price Movement

Prices aren’t declining dramatically, but they’re no longer jumping at the pace we saw in 2021-2023. Zillow’s home value data shows similar stabilization patterns across major metros. Compared to 2025, many neighborhoods are seeing flat to modest appreciation, typically in the 1-3% range. Compared to 2024, appreciation is still positive overall but noticeably slower—which is actually healthier for long-term buyers and sellers.

This stabilization has brought more balance to negotiations and removed much of the panic that drove irrational decision-making in prior years.

How Different Price Points Are Behaving

Not all segments are moving the same, and understanding these differences matters:

- Starter homes and entry-level properties remain competitive, especially when priced correctly. These homes continue to attract multiple buyers, though with fewer extreme bidding wars than before.

- Mid-range single-family homes are moving steadily, particularly when they’re updated and marketed well. This is the sweet spot where prepared buyers are finding real opportunities.

- Townhomes and condos have become more attractive as affordability remains a consideration. Solid activity continues in this segment as buyers seek alternatives to single-family pricing.

- Luxury and higher-priced homes are taking longer to sell and require sharper pricing and stronger presentation. Buyers at this level are more selective and negotiating more confidently.

Real-World Pricing Example

To put this into perspective: a 3-bedroom, 2-bath home in Durham that was priced around $360,000-$380,000 in 2024 is now often listing in the $395,000-$420,000 range in early 2026. However, these homes are seeing more days on market and more room for negotiation than in previous years.

In Raleigh, similar homes that pushed aggressive pricing in 2024 are now being priced more intentionally. Sellers are focusing on value, condition, and incentives rather than assuming automatic appreciation will carry them through.

The key takeaway? This is a market defined by realistic pricing, informed buyers, and strategic sellers. Values are holding, appreciation is still present in many areas, and opportunities exist—especially for those who are prepared.

Interest Rates Impact on the North Carolina Housing Market in 2026

Alt text: North Carolina housing market mortgage interest rates 2026 showing rates around 6 percent for homebuyers

What Rates Are Buyers Locking In?

Right now, most buyers securing financing are seeing 30-year fixed mortgage rates in the low-to-mid-6% range—roughly around 6.1-6.4%, depending on credit profile and lender pricing. According to Freddie Mac’s mortgage rate data, some buyers are even locking in rates in the high 5% range when conditions align.

This doesn’t feel like the ultra-low era of 3-4%, but it represents meaningful progress from when rates hovered closer to 6.7-7% and above in the past couple of years. And here’s what matters most: even a small dip in rates brings buyers off the sidelines and increases purchasing power.

The Truth About “Waiting for Lower Rates”

I always start with this perspective: you don’t have to wait for perfection to make wealth-building moves.

Real purchasing power isn’t just about the rate—it’s about payment, terms, and timing. Today’s rates are historically reasonable and sustainable. Locking in a great home today with a solid payment beats waiting indefinitely for a “fantasy rate” that may never materialize.

A smart homebuyer understands that waiting for an ideal rate often means losing ground to inventory trends, rising prices, and personal life goals. The cost of waiting can exceed the benefit of a slightly lower rate—especially when you factor in continued rent payments and missed equity building.

Creative Financing Strategies in the Current Market

With rates in this environment, we’re seeing smart strategies emerge that help buyers win:

Rate buydowns (2/1 and 3/2 structures) are being used to reduce payments in the first couple of years, making homes more affordable during the adjustment period.

Seller concessions are becoming part of successful offers, especially on closing costs, appraisal gaps, and rate-buydown assistance.

Adjustable-rate mortgages (ARMs) and shorter-term financing options appeal to buyers who plan to move again or refinance when rates shift in the future.

The game isn’t about avoiding rates—it’s about structuring the deal to fit your goals and timeline. That’s where prepared buyers create wins in early 2026.

Monthly Payment Reality Check

Even with rates in the mid-6% range, monthly payments on a typical Triangle home (median values in the mid-$400Ks) remain manageable—especially compared to rent in many parts of Durham, Raleigh, and Chapel Hill.

While buyers with 3% mortgages from years ago secured lower payments, today’s rates are not unaffordable. They’re encouraging many would-be buyers to reenter the market because payments are stabilizing and predictable for planning purposes.

Remember: if prices surge again later, waiting might cost you more than buying now. A great rate is valuable, but a smart decision beats waiting for an impossible one.

Housing Inventory Levels and Market Activity in North Carolina

Alt text: North Carolina housing market days on market 2026 Triangle region inventory levels Raleigh Durham

More Choices for Triangle Buyers

Across the Triangle, we’re seeing more homes come to market than we have in recent years, giving buyers more choice and breathing room than the super-tight inventory of 2021-2023. This means buyers aren’t forced to make snap decisions—they can do their homework and find a property that truly fits their needs.

Raleigh and Wake County: In places like Raleigh, Cary, and Apex, we’re seeing a healthy pool of available homes. Buyers can now compare options instead of grabbing the first listing they see.

Durham and Orange Counties: Choice is expanding here too, with buyers enjoying more neighborhoods and price points to evaluate without the extreme competition of previous years.

How Long Are Homes Taking to Sell?

Homes are still selling—but they’re not flying off the market in a day like they were during the pandemic peak. Current trends show:

Raleigh-Cary area: Around 55-60 days median time on market before going under contract, with some reports showing averages closer to 36 days for well-priced, desirable properties.

Triangle overall: Inventory and days on market rising together suggest we’re no longer in a panic-buy environment. This is a more balanced market where buyers have time to move with intention.

What this tells me—and what I share with clients—is that you can pause, evaluate, and act strategically rather than feeling rushed into a decision you’ll regret.

Neighborhood and Property Type Differences

Certain markets and property types are still moving faster:

Renovated, move-in-ready homes still attract quicker action and sometimes multiple offers.

Single-family homes in desirable school zones and near major employment centers typically see higher traction and shorter market times.

Luxury and niche segments may stay on the market longer, giving buyers in these price ranges more negotiation leverage and time to evaluate.

My Advice to Buyers Right Now

If you find “the one,” don’t assume you have forever—but also don’t feel pressured into a bad deal. We’re in a balanced market, not a frenzied one, which means the buyers who win are the prepared ones.

Here’s what I recommend:

Get pre-approved before you start searching. This sets clear expectations and shows sellers you’re serious.

Know your must-haves versus nice-to-haves. This clarity helps you move quickly and confidently when a great home appears.

Work with a local agent who knows the neighborhoods. Sometimes days matter more than dollars, and local expertise makes the difference.

Be ready to write a strong offer—but not a desperate one. A balanced market gives you choice, clarity, and authority to decide on your terms.

Shifts in North Carolina Real Estate Buyer and Seller Behavior

How Buyers Are Acting Differently in the North Carolina Housing Market

One of the biggest changes isn’t just in the numbers—it’s in how buyers are thinking and behaving. The emotional frenzy of the past few years has eased, and the market is being driven more by intention, preparation, and realism.

Negotiation is back. Buyers are more comfortable asking for closing cost assistance, repairs, or credits—especially when homes have been sitting longer on the market.

Inspections are fully back in play. Most buyers are no longer waiving inspections or appraisal contingencies like we saw in 2021-2023. Due diligence is being taken seriously again, which protects buyers and creates healthier transactions.

Buyers are comparing options. Instead of jumping on the first house they see, many buyers are viewing multiple homes and taking time to assess value and fit.

Urgency still exists—but it’s selective. When the right home shows up (priced well, in a strong location, move-in ready), buyers will still move quickly. But they’re not rushing into bad fits or compromising on fundamentals.

The biggest mindset shift I’m coaching buyers through? You don’t have to panic—but you do need to be prepared. A thoughtful buyer with financing lined up and clear priorities still wins in this market.

How Sellers Need to Adapt in the North Carolina Housing Market

On the seller side, I’m seeing a wide range of readiness—and that’s where strategy really matters. The Mortgage Reports notes that sellers nationwide are adjusting expectations as markets normalize.

Well-prepared sellers are pricing realistically from the start. These homes move efficiently with less friction and fewer price reductions.

Overpricing is still happening—but it’s getting corrected faster. Sellers who try to chase yesterday’s market often face price reductions or extended days on market, which can create negative perception among buyers.

Presentation matters again. Sellers are realizing they can’t rely on demand alone. Condition, staging, photography, and marketing make a real difference in attracting serious buyers.

Concessions are becoming strategic tools. Offering closing cost assistance or flexible terms isn’t a sign of weakness—it’s smart positioning in a more balanced environment.

The biggest mindset shift I’m coaching sellers through is this: the market will reward strategy, not stubbornness. Today’s buyers are informed, and sellers who align with current conditions sell faster and with less stress.

Contract Terms and Contingencies

What’s noticeably different from the peak years:

- Inspection contingencies are standard again

- Appraisal contingencies are common and expected

- Financing contingencies are back in most transactions

- Fewer “as-is, no questions asked” offers unless the property truly warrants it

This is a healthier market—one where both sides have protections and clarity. Transactions are more balanced, and that benefits everyone involved in the long run.

2026 North Carolina Housing Market Forecast and Predictions

Alt text: North Carolina housing market forecast 2026 predictions prices trends Triangle region real estate outlook

Price Predictions for the Rest of 2026

Based on everything I’m seeing on the ground and national trends, I expect modest appreciation overall for the North Carolina housing market, with some neighborhoods remaining flat and others still climbing—especially areas near job centers, strong school systems, and desirable amenities.

National outlooks point to low-to-mid single-digit growth, not the runaway appreciation we saw in previous years. This creates a more sustainable market where values build steadily rather than speculatively.

Inventory Outlook

I anticipate more listings throughout 2026, continuing the trend of inventory rebuilding. However, we’re still not at “normal” pre-2020 levels, which means supply remains somewhat constrained in desirable areas. This balance between improving inventory and continued demand should keep the market stable without dramatic swings in either direction.

Interest Rate Expectations

Rates ended 2025 around 6.15% on average for a 30-year fixed mortgage, and multiple forecasts suggest they’ll hover near or just above 6% through 2026. This matters because even a small dip brings buyers off the sidelines and increases purchasing activity.

While no one can predict rates with certainty, the current environment suggests we’ve moved past the peak rate anxiety and into a more predictable range that allows buyers to plan with confidence.

Wild Cards I’m Watching

Several factors could influence the North Carolina housing market trajectory in 2026:

Jobs and migration into the Triangle: This remains a major driver of housing demand. The Research Triangle Regional Partnership continues tracking strong economic growth indicators. As long as companies continue expanding in the Research Triangle and bringing employees to the region, demand will stay strong.

New construction and permitting pace: More supply can keep prices from jumping too fast and provide alternatives for buyers who can’t find existing inventory.

Policy shifts: Any changes that impact affordability, lending standards, or housing supply could alter market dynamics throughout the year.

My Best Advice on Market Timing

Here’s the truth I live by: timing the market perfectly is a trap. What actually works is timing your readiness.

If you’re buying: Get your financing strategy tight, know your numbers, understand your priorities, and move when the right home appears. Don’t wait for a mythical “perfect moment” that may never arrive.

If you’re selling: Don’t “test” the market with unrealistic pricing. Lead the market with smart pricing, strong presentation, and marketing that makes your home the obvious choice for prepared buyers.

It’s always a good time to make your move in real estate when you’re prepared and the move aligns with your goals. The winners in 2026 won’t be the ones who waited for perfect conditions—they’ll be the ones who moved forward with a solid plan and expert guidance.

What the North Carolina Housing Market Means for You

For First-Time Homebuyers in North Carolina

You have more leverage, more options, and more time to think than buyers had during the frenzy years. Affordability is still a consideration, but creative financing, improving inventory, and realistic negotiations make homeownership achievable in 2026.

The key is preparation: get pre-approved, understand your budget realistically, and work with someone who can guide you through the Triangle market specifically. Consider exploring first-time homebuyer programs in North Carolina for additional assistance.

For Move-Up Buyers and Sellers

If you’re trying to decide whether to sell first or buy first, the answer depends on your specific situation, equity position, and timeline. The good news? The balanced market creates flexibility you didn’t have in 2021-2023.

You can negotiate contingencies, take time with due diligence, and structure transactions that protect your interests on both sides. This is exactly when strategic guidance makes the biggest difference.

For Out-of-State Buyers Relocating to North Carolina

The Triangle continues to attract people from across the country for career opportunities, lifestyle, and relative affordability compared to other major metros. Understanding local neighborhoods, pricing nuances, and market timing requires boots-on-the-ground expertise.

Don’t rely on generic national advice—work with someone who knows Durham versus Raleigh versus Chapel Hill intimately and can match you to the right area for your specific needs.

For Investors and Wealth-Builders

2026 presents opportunity and stability. Modest appreciation, improving inventory, and reasonable financing costs create conditions where smart acquisitions make sense—especially in growth corridors where employment and population trends remain strong.

The key for investors is understanding which segments and locations offer the best risk-adjusted returns, and that requires local market intelligence, not just spreadsheet analysis.

Ready to Make Your Move in the North Carolina Housing Market?

The North Carolina housing market in 2026 isn’t something to fear or overthink. It’s a market to understand—and when you understand it, you can move forward with confidence.

Whether you’re a first-time buyer wondering if you can afford to get in, a seller trying to determine the right pricing strategy, or someone relocating to the Triangle and needing local guidance, the opportunity is here. The market hasn’t disappeared. It has simply matured into something more balanced, more strategic, and more navigable for those who are prepared.

You don’t need to figure this out alone. You need a local expert who understands this market, works with real buyers and sellers every day, and can translate data into decisions that align with your specific goals and timeline.

Let’s have a conversation about your next move. Whether you’re ready to start your search, considering selling, or just want to understand your options better, I’m here to provide the clarity and strategy you need.

Reach out today for a personalized consultation. Together, we’ll create a plan that makes sense for you—because when you’re prepared and working with the right guidance, it’s always a good time to make your move in real estate.

Related Resources:

-

- Homes for Sale in Durham NC – Are Prices Dropping in 2025?

- First-Time Homebuyer Guide for North Carolina

- Selling Your Home in Durham: Complete Guide

- Triangle NC Real Estate Update: What You Need to Know (November 2025)

- Real Estate in Raleigh: 7-Step Home Buying Guide

- Short Sale in North Carolina Guide 2025 | NC Expert Tips

The North Carolina housing market continues to evolve throughout 2026. Stay informed with ongoing market insights, analysis, and guidance tailored to the Triangle region. Subscribe for updates and be the first to know about shifting trends, new opportunities, and strategic timing for your real estate goals.