The Complete Guide to Short Sale Properties in North Carolina: Everything You Need to Know in 2025

When financial hardship strikes homeowners, a short sale often becomes the most viable solution to avoid foreclosure. Furthermore, savvy investors and homebuyers find that North Carolina short sale homes present unique opportunities to acquire properties at below-market prices. However, navigating the complex world of short sales requires expert knowledge and professional guidance.

If you’re facing potential foreclosure, the HUD foreclosure alternatives program provides valuable resources and guidance for homeowners exploring their options.

What is a Short Sale and How Does It Work in North Carolina?

In a short sale, the homeowner sells the property for less than the outstanding mortgage balance, and consequently, the lender agrees to accept the reduced amount as full payment. Moreover, this process helps distressed homeowners avoid the devastating effects of foreclosure while allowing lenders to recover a portion of their investment.

In North Carolina, lenders and real estate professionals have streamlined the short sale process over the years, nevertheless, it still requires careful navigation of state-specific regulations and procedures. Additionally, homeowners and agents must address NC short sale legal issues properly to ensure all parties receive protection throughout the transaction.

Key Components of North Carolina Short Sale Rules

The state of North Carolina has established specific guidelines that govern short sale transactions, as the North Carolina Real Estate Commission regulates. Initially, lawmakers created these rules to protect both buyers and sellers in distressed property situations. Subsequently, the state has implemented several important regulations:

- Hardship Documentation: Homeowners must thoroughly document and verify financial distress

- Property Valuation: Appraisers must conduct market analysis to justify the reduced sale price

- Lender Communication: Sellers must contact all mortgage holders and initiate negotiations

- Legal Compliance: All parties must follow state and federal regulations throughout the process

Short Sale vs Foreclosure NC: Understanding Your Options

When comparing short sale vs foreclosure NC options, homeowners will find significant differences in both process and consequences. Notably, each option carries distinct advantages and disadvantages that homeowners should carefully consider.

Short Sale Benefits

- Short sales typically impact credit scores less severely than foreclosures

- Lenders may offer homeowners relocation assistance

- Professionals generally complete the process faster than foreclosure

- Homeowners restore future home purchasing eligibility more quickly

Foreclosure Consequences

- Foreclosures can damage credit scores for 7-10 years

- Lenders may initiate legal proceedings against the homeowner

- Lenders may pursue deficiency judgments

- The entire process can take significantly longer to complete

Therefore, most financial advisors recommend exploring short sale options before homeowners allow foreclosure proceedings to begin.

Will a Short Sale Hurt My Credit in North Carolina?

Yes, a short sale will impact your credit score, but the damage typically causes less severity than a foreclosure. Most North Carolina homeowners see their score drop anywhere from 85 to 160 points, depending on their overall credit history and financial situation.

The good news is that homeowners usually experience faster recovery timelines:

Short Sale: Many homeowners can qualify for a new mortgage in as little as 2–3 years after completing a short sale, provided they maintain good credit habits.

Foreclosure: Credit damage can last 7–10 years, making it much harder to buy another home.

Additionally, some lenders may report a short sale differently (e.g., “settled” or “paid for less than the full balance”), which looks far better on your credit report than a foreclosure judgment.

👉 Bottom line: While a short sale will hurt your credit, homeowners often find it the less damaging option compared to foreclosure—and with proper financial planning, recovery becomes very achievable.

📌 Pro Tip: Every homeowner’s financial situation differs uniquely. If you’re worried about how a short sale could affect your credit, reach out to Latrice McFadden,a certified short sale professional in North Carolina. She’ll walk you through your options, explain credit recovery strategies, and help you make the best decision for your future.

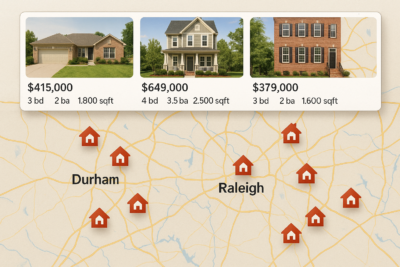

Finding North Carolina Short Sale Homes: MLS Listings and Market Opportunities

NC short sale MLS listings have become increasingly accessible through various online platforms and real estate databases. Moreover, working with a qualified short sale agent North Carolina provides access to exclusive opportunities that platforms may not advertise widely.

Where to Find NC Short Sale Listings

Professional real estate agents specializing in distressed properties maintain comprehensive databases of available short sales. Additionally, these experts understand the nuances of North Carolina short sale property for sale and can guide both buyers and sellers through complex transactions.

Short sale in Raleigh, NC and short sale in Charlotte NC markets have shown particular activity due to these metropolitan areas’ economic dynamics. Furthermore, surrounding suburban communities often present excellent opportunities for both investment and primary residence purchases.

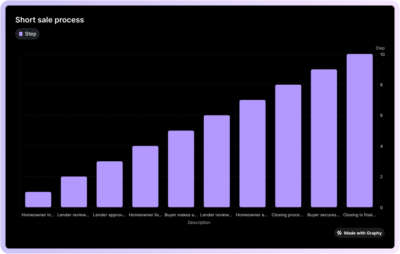

The Short Sale Process in North Carolina: Step-by-Step Guide

Understanding the short sale process in North Carolina proves essential for anyone considering this option. Initially, the process begins when homeowners recognize they can no longer maintain their mortgage payments. Subsequently, homeowners must complete several critical steps:

Phase 1: Initial Assessment and Documentation

- Homeowners must document financial hardship with supporting evidence

- Licensed appraisers conduct property value assessments

- Sellers gather all mortgage statements and loan documents

- Homeowners may consult legal counsel regarding potential implications

Phase 2: Lender Communication and Approval

NC lender approval short sale procedures require extensive documentation and negotiation. Consequently, this phase often takes several months to complete successfully. Moreover, multiple mortgage holders may need to approve the transaction terms.

Phase 3: Marketing and Sale Execution

After the lender approves the short sale, the agent markets the property through appropriate channels. Additionally, potential buyers must understand they are buying a short sale in NC and prepare for extended closing timelines.

Legal Considerations: Deficiency Judgments and Tax Implications

North Carolina deficiency judgment short sale laws provide important protections for homeowners, however, understanding these regulations proves crucial before proceeding. Furthermore, short sale tax consequences NC can significantly impact your financial situation both immediately and in future tax years.

Deficiency Judgment Protections

In certain circumstances, North Carolina law prevents lenders from pursuing deficiency judgments. Nevertheless, homeowners must meet specific conditions to qualify for these protections. Additionally, experts strongly recommend that homeowners consult with qualified legal counsel before finalizing any short sale agreement.

Tax Implications and Consequences

The IRS may consider forgiven debt as taxable income, therefore, understanding short sale tax consequences NC proves essential for proper financial planning. According to the IRS guidelines on canceled debt, debt forgiveness can result in taxable income unless specific exceptions apply. Moreover, the IRS home foreclosure and debt cancellation provisions have provided some relief for distressed homeowners, but individual circumstances vary significantly.

Working with Short Sale Professionals in North Carolina

Selecting the right short sale agency in North Carolina can make the difference between a successful transaction and a costly mistake. Furthermore, experienced professionals understand the intricacies of short sale requirements North Carolina and can navigate potential obstacles effectively.

Essential Qualities of Short Sale Agents

- Extensive experience with distressed property transactions

- Strong relationships with local lenders and financial institutions

- Comprehensive understanding of North Carolina real estate law

- Proven track record of successful short sale completions

Moreover, NC short sale negotiation with lender requires specialized skills that not all real estate agents possess. Consequently, working with certified short sale specialists ensures the best possible outcomes for all parties involved.

Investment Opportunities: Short Sale of Distressed Property in North Carolina

Short sale of distressed property in North Carolina presents unique opportunities for real estate investors and homebuyers seeking below-market properties. However, these transactions require patience, expertise, and adequate financial resources to complete successfully.

Key Investment Considerations

- Inspectors must conduct property condition assessments thoroughly

- Buyers may find financing options limited compared to traditional sales

- Lender approval processes typically extend closing timelines

- Investors should ensure market analysis accounts for neighborhood trends and future development

Additionally, investors should understand that sellers offer short sale properties “as-is,” therefore, buyers must conduct comprehensive inspections and due diligence before committing to purchase. For additional resources on distressed properties, HUD’s home sales program offers valuable information for both buyers and investors.

Conclusion: Navigate Short Sales Successfully with Professional Guidance

The world of short sales in North Carolina offers both challenges and opportunities for homeowners, buyers, and investors alike. Moreover, understanding the complex regulations, procedures, and market dynamics requires extensive knowledge and professional expertise.

Whether you’re facing financial hardship and considering a short sale, or you’re interested in purchasing distressed properties, working with qualified professionals proves essential for success. Furthermore, the right guidance can help you navigate legal requirements, negotiate with lenders, and complete transactions efficiently.

Ready to explore short sale opportunities in North Carolina? Contact Latrice McFadden today for a comprehensive consultation. We’ll evaluate your unique situation, explain your options, and guide you through every step of the process. Don’t let financial challenges or market opportunities pass you by – take action today and secure your financial future with expert short sale assistance.

I am Latrice McFadden, a certified short sale professional who serves clients throughout North Carolina, including Raleigh, Charlotte, and surrounding communities. Contact now for your free consultation and discover how short sales can solve your real estate challenges.