Triangle Market Update for December 2025: What Buyers and Sellers Need to Know

As we close out 2025, the Triangle real estate market continues to demonstrate remarkable resilience amid evolving economic conditions. Whether you’re considering buying your first home, selling your property, or investing in the region, understanding the current market dynamics is essential for making informed decisions. This comprehensive Triangle market update breaks down everything you need to know about home prices, inventory levels, mortgage rates, and what lies ahead for 2026.

Current State of the Triangle Real Estate Market 2025

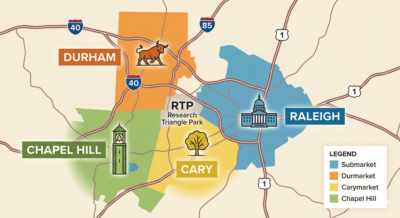

The Triangle area—encompassing Raleigh, Durham, Chapel Hill, Cary, Apex, and surrounding communities—remains one of the most dynamic housing markets on the East Coast. The median price for single-family homes stands at approximately $425,000, reflecting a modest increase of three to four percent compared to 2024. This measured growth signals a healthy market that has successfully transitioned from the frenzied pace of previous years to a more sustainable trajectory.

What makes this particularly noteworthy is the continued demand despite mortgage rates hovering in the mid-six percent range. The Triangle’s appeal extends far beyond traditional market factors, driven by its reputation as a technology hub, exceptional educational institutions, and outstanding quality of life.

Home Prices and Market Dynamics

Price appreciation in the Triangle has moderated considerably from the explosive growth witnessed during the pandemic years. The Triangle’s median home price currently ranges between $450,000 and $500,000, which has remained relatively stable over the past two years. However, not all submarkets are experiencing identical trends.

Different areas within the Triangle tell unique stories. Wake County communities like Cary, Apex, and Holly Springs remain seller’s markets with less than three months of inventory, while areas such as Fuquay-Varina, Clayton, and Zebulon have transitioned into buyer’s markets with six months or more of available inventory. This geographic variation presents strategic opportunities for both buyers and sellers depending on their target location.

Durham County has shown particularly impressive performance, with prices increasing seven percent year-over-year. The city’s combination of affordability relative to Raleigh and its thriving cultural scene continues attracting homebuyers seeking value without sacrificing urban amenities. Chapel Hill maintains its position as the premium market, with median prices exceeding $600,000 due to limited inventory and consistent demand fueled by the university community.

Triangle Real Estate Market 2025: Inventory Levels – The Supply Story

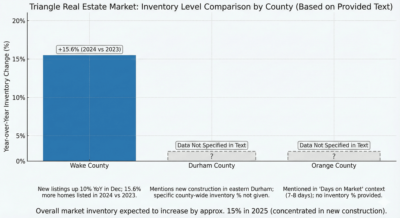

One of the most significant developments in the Triangle real estate market has been the inventory situation. Wake County saw new listings rise ten percent year-over-year in December, with 2024 recording 15.6 percent more homes listed compared to 2023. This represents a welcome shift for buyers who have faced limited options in recent years.

The “lock-in effect”—homeowners reluctant to sell because they secured historically low mortgage rates in previous years—has been a persistent challenge. Many property owners with rates below four percent have chosen to stay put rather than trade up to mortgages in the six to seven percent range. However, life changes, job relocations, and the natural progression of housing needs are gradually bringing more homes to market.

Inventory is expected to increase by approximately fifteen percent in 2025, providing buyers with more options than in recent years. This inventory expansion is particularly concentrated in new construction developments, with builders ramping up activity in fast-growing areas like Wake Forest, Apex, and parts of eastern Durham.

Days on Market: A Key Indicator

Market velocity tells an important story about demand strength. The average time homes spend on the market has dropped to just seven to eight days across Wake, Durham, and Orange counties. This rapid turnover indicates that well-priced, well-presented properties continue commanding strong buyer interest despite higher financing costs.

This quick absorption rate stands in stark contrast to 2013, when properties sat on the market for 100 to 110 days. The current environment requires buyers to act decisively when they identify suitable properties, as competition remains fierce for quality homes in desirable locations.

Triangle Real Estate Market 2025: Mortgage Rates and Affordability

Interest rates remain the wild card in the housing equation. The thirty-year fixed-rate mortgage averaged 6.23 percent as of late November 2025, down from 6.81 percent a year earlier. While this represents improvement, rates remain significantly elevated compared to the pandemic-era lows that many homeowners remember.

Looking forward, forecasters project the thirty-year fixed rate at 6.8 percent in early 2025, declining marginally to 6.4 percent throughout the year. The consensus among housing authorities suggests rates will stabilize in the six to 6.8 percent range throughout 2025, with gradual decreases possible as economic conditions evolve.

For prospective buyers waiting for rates to dip below six percent—or hoping for a return to five percent or lower—the reality check is sobering. Such dramatic decreases appear unlikely in the near term. Instead, the focus should shift to finding properties that meet long-term needs, as housing appreciation has historically outpaced the cost differential between slightly higher and lower interest rates over extended holding periods.

Creative Financing Solutions

The elevated rate environment has sparked innovation in financing strategies. Adjustable-rate mortgages have regained popularity among qualified buyers who anticipate refinancing opportunities as rates decline. Rate buydowns, where sellers contribute funds to temporarily reduce the buyer’s interest rate, have become negotiating tools in balanced and buyer-favorable markets.

Additionally, some buyers are pursuing properties they can afford at current rates with plans to refinance when opportunities arise, rather than remaining on the sidelines indefinitely. This approach allows them to begin building equity and potentially benefit from continued price appreciation.

Triangle Real Estate Market 2025: The Economic Foundation

The Triangle’s housing market doesn’t exist in a vacuum—it’s underpinned by one of the nation’s strongest economic engines. The Research Triangle Park continues attracting major technology companies and innovative startups, creating high-paying jobs that fuel housing demand.

Major employers like Apple, Google, and IBM have expanded their operations, bringing high-paying jobs and a steady stream of well-qualified professionals to the area. This corporate expansion shows no signs of slowing, with announcements of new facilities and workforce expansions occurring regularly.

The region’s universities—Duke, UNC-Chapel Hill, and NC State—contribute both directly and indirectly to housing demand. Faculty, staff, and graduate students represent consistent buyer and renter populations, while the institutions’ research activities spawn entrepreneurial ventures that grow into job-creating companies.

Population growth remains robust, with hundreds of new residents arriving monthly. Wake County alone has issued building permits for thousands of new residential units annually, yet construction has struggled to keep pace with household formation. This structural housing deficit provides fundamental support for home values and suggests sustained demand for the foreseeable future.

Triangle Real Estate Market 2025: Market Segmentation and Opportunities

Not all price points and property types are performing equally in the current market. Understanding these nuances helps buyers and sellers position themselves strategically.

Entry-Level Market

Properties priced below $350,000 remain highly competitive across most Triangle communities. First-time buyers, young professionals, and investors seeking rental properties actively pursue these homes, often resulting in multiple offers. Inventory at this price point is particularly constrained, as new construction costs make it challenging for builders to deliver homes profitably in this range.

Mid-Range Market

The $350,000 to $600,000 segment represents the market’s sweet spot, offering the broadest inventory and most balanced competition. Buyers in this range have meaningful negotiating leverage compared to previous years, particularly in communities with higher inventory levels. Sellers must price competitively and present properties in excellent condition to attract offers quickly.

Luxury Market

High-end properties above $600,000 have experienced the most significant deceleration. Luxury buyers are generally more rate-sensitive, as the monthly payment impact of higher interest rates is magnified on larger loan amounts. However, this segment offers opportunities for well-qualified buyers to negotiate favorable terms, including price reductions, closing cost contributions, and inclusion of furnishings or upgrades.

New Construction

New developments account for approximately thirty percent of Triangle home sales. Builders are responding to demand by focusing on suburban communities where land remains available, offering modern floor plans with energy-efficient features. Many builders provide incentives such as rate buydowns, closing cost assistance, or upgrades to stimulate sales, creating compelling value propositions for buyers willing to wait several months for completion.

Triangle Real Estate Market 2025: Neighborhood Spotlight

Different Triangle communities offer distinct value propositions:

Cary and Apex continue commanding premium prices due to highly-rated schools, excellent amenities, and convenient access to employment centers. These areas remain seller’s markets with limited inventory and quick sales.

Holly Springs and Fuquay-Varina represent more affordable alternatives while maintaining good schools and newer housing stock. Fuquay-Varina’s increased inventory creates negotiating opportunities.

Durham offers the best value proposition in the Triangle, combining reasonable prices, cultural vibrancy, and revitalized downtown areas. The city’s continued renaissance attracts buyers seeking character and diversity.

Wake Forest and Rolesville appeal to families seeking newer construction, good schools, and small-town charm within commuting distance to Raleigh.

Chapel Hill and Carrboro maintain their premium positioning, attracting buyers prioritizing walkability, cultural amenities, and proximity to UNC.

Looking Ahead to 2026

As we transition into the new year, several trends merit attention. The Federal Reserve’s monetary policy decisions will significantly influence buyer activity. Any stabilization or reduction in rates could reignite demand, particularly among buyers who have been waiting on the sidelines.

New construction investment will be critical for addressing inventory shortages and affordability concerns. Communities that streamline permitting processes and incentivize development will likely experience more balanced markets and improved affordability.

The Triangle’s economic momentum shows no signs of slowing. Ongoing job creation and business expansion will continue driving housing demand, supporting home values even if transaction volumes moderate from peak levels.

Predictions for 2026

Based on current trajectories and economic indicators, here’s what we anticipate for the Triangle housing market in 2026:

Home prices will likely appreciate in the three to five percent range, continuing the modest but steady growth pattern established in 2024 and 2025. This healthy appreciation reflects genuine demand rather than speculative excess.

Transaction volumes may increase slightly as interest rate stability encourages fence-sitters to enter the market. The combination of improving inventory and buyers adjusting to the rate environment should support increased activity.

Inventory will continue expanding gradually, with new construction playing an increasingly important role. However, inventory will remain below pre-pandemic norms, preventing any dramatic price corrections.

First-time buyers will face ongoing challenges due to limited entry-level inventory and elevated rates, but programs offering down payment assistance and favorable terms will provide pathways to homeownership.

Strategic Recommendations

For Buyers

Act When You Find the Right Property: In a market where quality homes sell within days, preparation and decisiveness are essential. Secure mortgage pre-approval, understand your budget, and be ready to move quickly when you identify suitable properties.

Focus on Long-Term Value: Rather than trying to time interest rates perfectly, prioritize finding homes that meet your needs for the next five to ten years. You can always refinance if rates drop, but you can’t refinance a poor location or unsuitable floor plan.

Consider Emerging Communities: Areas with higher inventory like Clayton, Zebulon, and Fuquay-Varina offer better negotiating leverage and potentially greater appreciation upside as infrastructure and amenities develop.

Work with Local Experts: The Triangle’s varied submarkets require specialized knowledge. Partner with experienced real estate professionals who understand neighborhood-specific dynamics and can identify opportunities others might miss.

For Sellers

Price Realistically: While the market remains healthy, days of automatic bidding wars have passed in most price ranges. Analyze recent comparable sales carefully and price competitively to attract serious buyers.

Prepare Your Property: First impressions matter tremendously in a market with expanded inventory. Invest in staging, professional photography, and necessary repairs to make your home stand out.

Timing Matters: Spring traditionally brings peak activity, but don’t overlook fall and winter opportunities. Serious buyers shop year-round, and reduced competition during off-peak periods can work to your advantage.

Be Flexible on Terms: In balanced markets, offering closing cost assistance, home warranties, or flexible possession dates can differentiate your listing and facilitate successful negotiations.

Conclusion: Opportunity in Balance

The Triangle real estate market has transitioned from the extremes of recent years to a more balanced, sustainable state. This normalization creates opportunities for both buyers and sellers willing to adapt their strategies to current conditions.

For buyers, expanded inventory and stabilizing rates provide more choice and negotiating leverage than at any point since 2020. While affordability challenges persist, the market is more accessible than it has been in years.

For sellers, continued demand from strong economic fundamentals supports home values, even as the market requires more thoughtful pricing and presentation strategies.

The Triangle’s combination of economic vitality, educational excellence, and quality of life ensures it will remain a premier destination for years to come. Whether you’re buying, selling, or investing, understanding these market dynamics positions you to make informed decisions aligned with your goals.

As we move into 2026, the fundamentals remain strong. The Triangle market update for December 2025 reveals a housing landscape that rewards preparation, flexibility, and partnership with knowledgeable professionals. The opportunities are abundant for those ready to engage with this thriving market.

For personalized guidance navigating the Triangle real estate market, consult Latrice McFadden of Make Your Move, Inc, a local real estate professionals who can provide insights specific to your situation and goals. Market conditions vary by neighborhood and price point, making expert local knowledge invaluable for successful outcomes.